net operating working capital definition

This liquidity ratio demonstrates how able a company is to pay off its current operational liabilities with its current operational assets. Net working capital represents the cash and other current assetsafter covering liabilitiesthat a company has to invest in operating and growing its business.

Change In Net Working Capital Nwc Formula And Calculator

You subtract your current.

. Net working capital is the difference between a businesss current assets and its current liabilities. BBY using the following balance sheets. Yes net working capital is the balance sheet difference between a companys current assets and current liabilities but more than that it is a measure of a companys operating liquidity and its ability to meet short-term obligations and fund the operations.

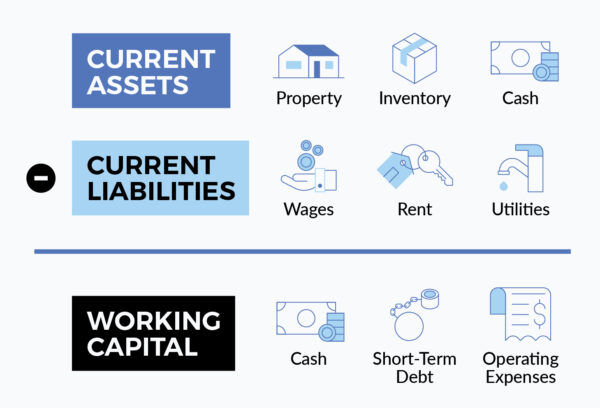

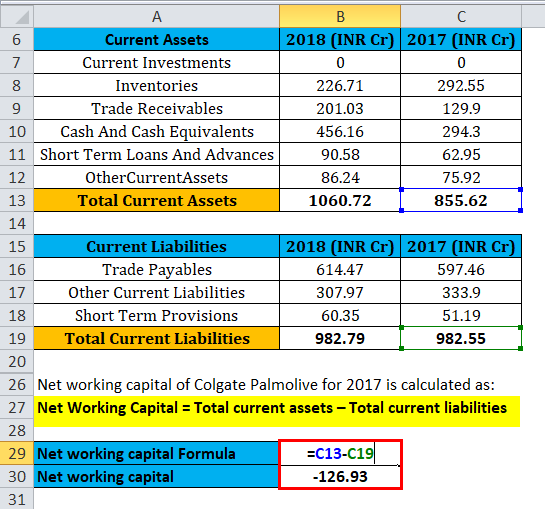

A net working capital formula is an equation that measures a companys ability to pay off current liabilities with assets. What is net working capital. Current assets - current liabilities net working capital.

Net working capital or NWC is the result of all assets held by a company minus all outstanding liabilities. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. You take all your total current assets.

Operating working capital or OWC is the measure of liquidity in a business. In fact cash and cash equivalents are more related to investing activities because the company could benefit from interest income while debt and debt-like instruments would fall into the financing activities. Net working capital is the aggregate amount of all current assets and current liabilities.

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. Harold Averkamp CPA MBA has worked as a university accounting instructor accountant and consultant for more than 25 years. Net working capital is calculated using line items from a businesss balance sheet.

It is a measurement of a companys liquidity and looks like this. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. In simplistic terms NWC represents a companys liquidity or ability to cover short-term obligations and may be defined as current assets less cash minus current liabilities less debt.

NWC is a way of measuring a companys short-term financial health. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses. Generally net operating working capital is equal to cash accounts receivables and inventories less accounts payable and accruals.

Gross working capital is equal to current assets. Use the following formula to calculate the net working capital ratio. In other words it represents that funds an entity has to cover short-term obligations such as payroll rent and utility bills.

What is the Net Working Capital Ratio. Its ability to keep running and growing business operations. They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and.

When a positive net working capital is derived it means that a company has enough funds to. Working capital is a financial metric which represents operating liquidity available to a business organisation or other entity including governmental entities. The reason NWC comes into play in MA transactions is that most businesses are valued based on future cash flows as.

Net Operating Working Capital Operating Current Assets Operating Current Liabilities Example Calculate total net operating capital for Best Buy Inc. Net working capital is a financial measure that determines if a business has enough liquid assets to pay its bills that are due in one. The net working capital ratio is the net amount of all elements of working capital.

Working capital management helps maintain the smooth operation of the net operating cycle also known as the cash conversion cycle CCCthe minimum amount of time required to convert net. Current assets - Current liabilities net. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital.

Operating working capital is defined as operating current assets less operating current liabilities. What Is the Operating Expense Formula. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial.

It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in. Net operating working capital current assets current liabilities. Current assets include cash accounts receivable and inventories and exclude marketable securities.

March 28 2019. What is net working capital. Net Working Capital NWC Operating Current Assets Operating Current Liabilities The reason is that cash and debt are both non-operational and do not directly generate revenue.

Operating current assets are assets that are a needed to support the business operations and b expected to be. Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating liabilities. Operating working capital is all assets minus cash and securities minus all short term non-interest debts.

For a company to function and run its operations seamlessly its important that a business owner keeps an eye on net working capital. In other words a companys ability to meet short-term financial obligations. Heres how to calculate net working capital how to.

Generally the larger your net working capital balance is the more likely it is that your company can cover its current obligations. Working capital is calculated as current assets minus current. Net working capital is nothing but the difference between a companys current assets and current liabilities.

Net working capital is also known simply as working capital. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. It is intended to reveal whether a business has a sufficient amount of net funds available in the short term to stay in operation.

Net operating working capital is defined as non-interest bearing current assets minus non-interest charging liabilities. And How To Calculate It Why is net working capital important.

Net Working Capital Template Download Free Excel Template

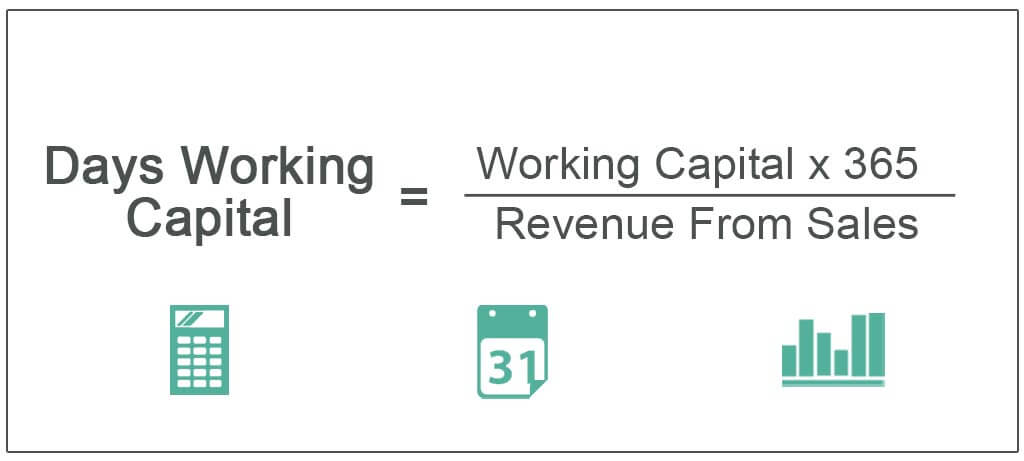

Days Working Capital Definition Formula How To Calculate

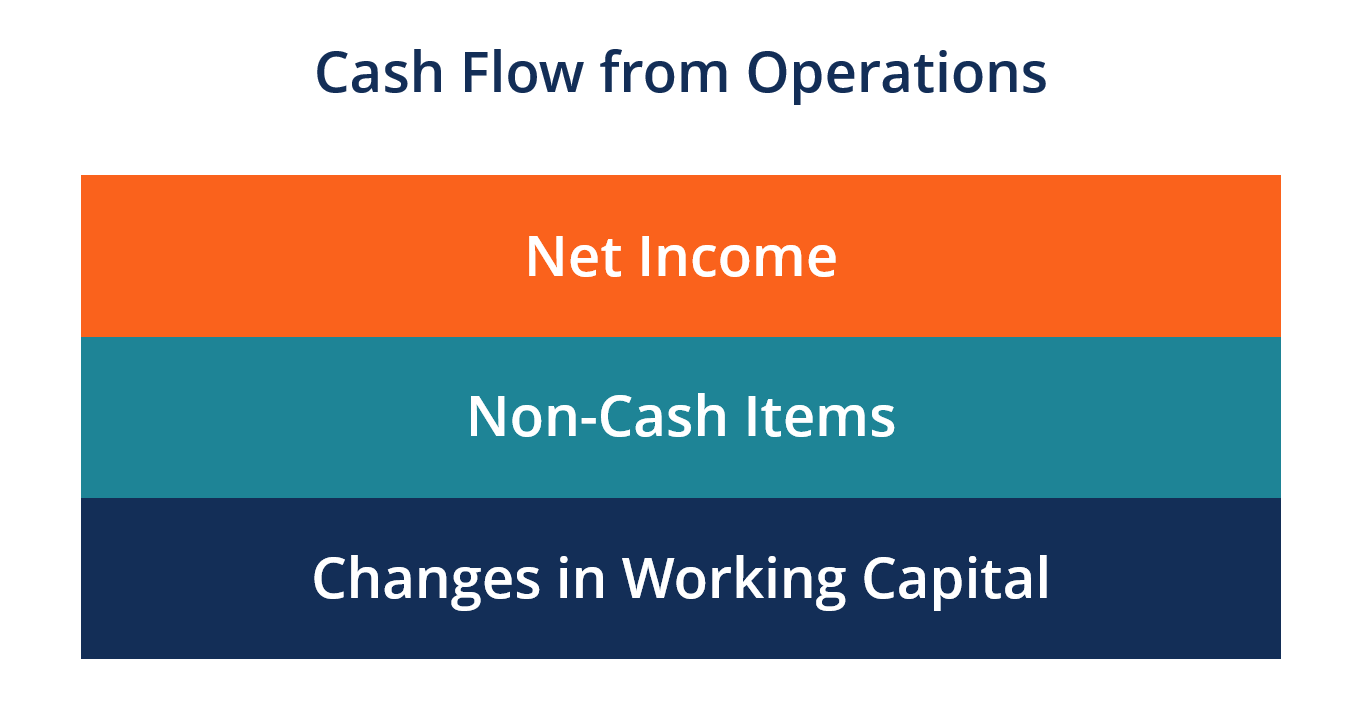

Cash Flow Formula How To Calculate Cash Flow With Examples

How To Calculate Working Capital Turnover Ratio Flow Capital

Net Working Capital Formula Calculator Excel Template

Working Capital What Is It And Why Do You Need It Business 2 Community

Types Of Working Capital Gross Net Temporary Permanent Efm

Net Working Capital Formula Calculator Excel Template

Free Cash Flow Formula Calculator Excel Template

Working Capital Cycle Efinancemanagement

Working Capital What It Is And How To Calculate It Efficy

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Ratio Analysis Example Of Working Capital Ratio

Changes In Net Working Capital All You Need To Know

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)